Fund Highlights

September 30, 2025 |

|

| Inception date | 1972 |

| Amortized Cost | $19.1 billion |

| Reserve balance | $131.5 million |

| S&P rating | AAAm |

| Weighted average maturity | 16 days |

| Quarterly effective yield | 4.38% |

| One-year total return | 4.61% |

| Five-year total return | 3.14% |

| Ten-year total return | 2.18% |

Investment Strategy

The fund seeks to minimize risk and enhance return on short-term cash for State, municipalities and other political subdivisions. STIF employs a top-down approach to developing its investment strategy. Starting with the objectives of the fund, STIF considers constraints outlined in its investment policy, which include parameters on liquidity management, maturity targets and permissible investment types.

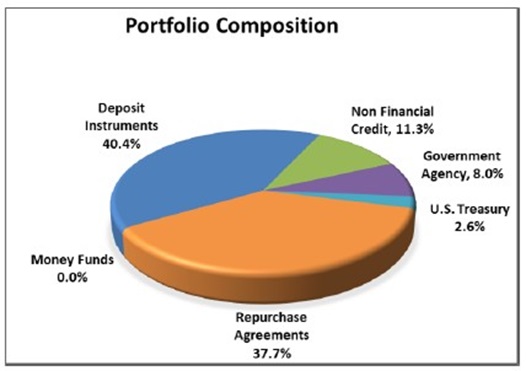

Fund Composition

STIF implements an investment strategy that assures the portfolio is well diversified.

As of September 30, 2025, the largest asset allocation categories were:

Deposit Instruments (40.4%)

Repurchase Agreements (37.7%)

Fund Management

Paul Coudert, Principal Investment Officer

Marc Gagnon, Investment Officer

Robert Scully, Investment Officer

Jan Hong, Senior Investment Associate

Danielle Thompson, Investment Technician