The Number 1 objection to purchasing LTCI is the cost. And the cost of LTCI can be substantial if the purchase is made later in life, such as after a person's 65th birthday. However, the purchase of LTCI at a younger age can be of great benefit. First, purchasing LTCI at a younger age can dramatically reduce the cost of premiums. Similar to life insurance, the younger you are at the time of LTCI purchase, the lower the premium. Secondly, the policyholder will have coverage if he/she requires long-term care services at a younger age. Contrary to popular belief, long-term care is not an issue just for the elderly. According to Chronic Care in America: A 21st Century Challenge, published by the Robert Wood Johnson Foundation, almost 1 in 4 adults between the ages of 45 and 64 are limited in activities because of a chronic condition.

Lastly, younger purchasers can get more LTCI benefits for less. It is often perceived that younger purchasers will pay more in premiums because they will be paying premiums for a longer period of time as compared to older purchasers. Based on an analysis conducted by the Connecticut Partnership for Long-Term Care, the best time to begin planning for long-term care is before age 60 (see below).

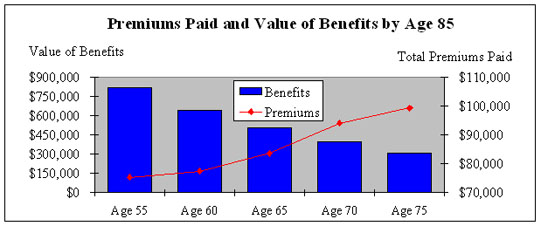

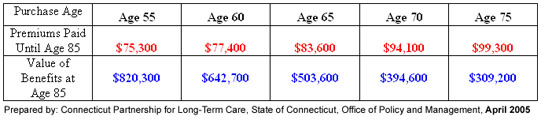

The graph above compares the total premium cost and value of insurance benefits of a Partnership Policy depending on when it was purchased between ages 55 and 75. It is assumed premiums are paid annually until long-term care services are needed at age 85. The chart indicates that the best time to purchase long-term care insurance is prior to one's 60th birthday. This is due to the combined effects of low annual premiums (shown in red) that remain level, and benefits (shown in blue) that increase by 5% compounded annually.

The example is based upon a Partnership Policy with a $260 daily benefit for home health care and nursing facility care with total benefits of approximately $190,000 (two year policy). The policy has a 100-day deductible (waiting period) and the daily and lifetime benefits will increase annually at a 5% compounded rate. The annual premiums are level. (Premiums can increase in the future if approved by the Connecticut Department of Insurance. Such increases are not considered here.)

If someone bought this Partnership Policy today at age 55, they would spend $75,300 in premiums over 30 years. The policy would provide up to $820,300 in benefits by the time they were age 85 due to 30 years of 5% compounded inflation protection. If the policy paid all of its benefits, the person would have also earned $820,300 in Medicaid Asset Protection.

Please note that the Connecticut Partnership for Long-Term Care requires that benefits from a Partnership policy inflate at a rate of no less than 3.5% compounded each year. This example uses 5% compound inflation protection for illustration purposes.

A second objection to purchasing LTCI is the complexity of the product. There are several decisions that a purchaser of LTCI needs to make, including the type of long-term care he/she would want to receive, the amount of benefit to be paid on a daily basis, the total amount of coverage to purchase, and whether or not to include inflation protection. Employers have a distinct advantage in that they can design a policy that addresses these issues and takes the "guess work" out for the purchaser. A well-designed LTCI plan that includes a comprehensive package of long-term care services, a high daily benefit, and inflation protection would go a long way in making the decision easier for employees. If the employee offering included payroll deduction as a means of paying the premium, the purchase is made all the easier.

Another objection to purchasing LTCI is the inability to pass underwriting. As with most insurance, LTCI has to be purchased before long-term care is needed. Persons who have been diagnosed with a chronic condition, such as Parkinson's Disease or Multiple Sclerosis, would not be eligible for LTCI on an individual basis. In the workplace, however, the underwriting rules can be negotiated and relaxed as part of the offering. In some cases, the underwriting rules can be eliminated entirely (known as guaranteed issue) for active employees during an open enrollment period. Such an offering would make LTCI available to people who otherwise would not qualify for coverage.

Lastly, many people will not purchase LTCI unless the employer contributes to the cost of premiums. Most of the successful employer offerings of LTCI have been those where the employer has contributed to the cost of the insurance premiums. Having the employer contribute to the cost sends a very strong message to employees that the company believes the benefit being offered is an important one. Employer contributions to LTCI have been made easier by federal legislation passed in 1996 that allows LTCI to be treated under the federal tax code in the same manner as health and accident insurance. Therefore, an employer who contributes towards an employee's LTCI premium can deduct that contribution in the same manner as the deduction for health insurance costs. While Congress did not allow LTCI to be included in a cafeteria or flexible-spending plan, the tax provisions do offer incentives for employers to offer LTCI as a benefit.

LTCI not only provides valuable insurance coverage, but it can be an important investment for younger purchasers as well. And, because LTCI is an appropriate retirement planning tool, employers can provide a critical link in reaching younger purchasers and overcoming many of the purchasing objections.

For more information contact:

OPM.CTPartnership@ct.gov

(860) 418-6318