Press Releases

12/08/2016

Gov. Malloy and State Employee Unions Reach Agreement on Pensions That Will Support the Employee Retirement System While Strengthening the State's Financial Obligations

(HARTFORD, CT) – Governor Dannel P. Malloy and representatives from the State Employees Bargaining Agent Coalition (SEBAC) today announced that after months of productive negotiations between the administration and SEBAC representatives, an agreement has been reached to modify the funding calculation and amortization schedule for the State Employee Retirement System (SERS) to help avoid the fiscal cliff the state would otherwise face in the coming years. The purpose of the agreement, which now heads to the General Assembly for approval, is to allow the state to fully fund its pension obligations on a stable, predictable basis while continuing to support the state’s retirement system.

Over many decades, legacy costs, insufficient contributions, and lower-than-assumed returns on investments have left Connecticut with an unfunded liability of nearly $15 billion for SERS. Since 2011, Governor Malloy has remained committed to fully funding pension payments – which have increased 90 percent since he took office – to resolve the unfunded liability and move the state into more sound financial footing. In addition, a 2011 agreement with SEBAC made state employee benefits more affordable, and also required current employees to increase their retiree health care contribution. Subsequently, the administration worked with the Center for Retirement Research at Boston College to conduct a forensic analysis of the past problems and make suggestions for the future.

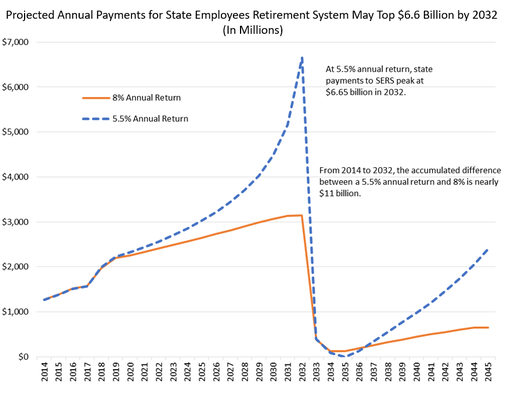

Today’s agreement – which does not impact benefits or employee contributions – builds on that work to provide budget stability for taxpayers, businesses, and investors. The state can now move ahead on a clear path to resolving one of the state’s most significant liabilities without undermining benefits or underfunding our responsibilities. Inaction could have resulted in state payments – out of the General Fund – eclipsing $4 to $6 billion for each year in the 2030s. In order for the state to meet those obligations, there would have been drastic cuts to services or unprecedented tax increases. This agreement will help avoid a fiscal cliff and put the state on a more sustainable course the taxpayers demand.

Specifically, the agreement includes:

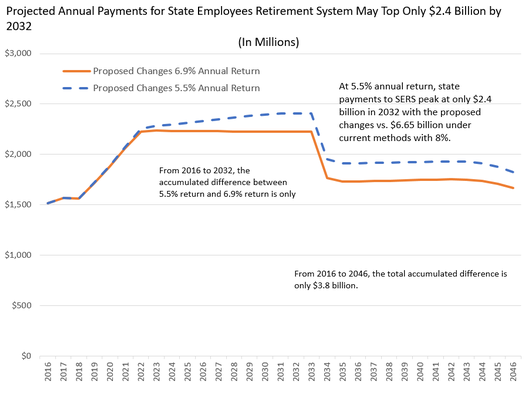

- Reducing the assumed rate of return from 8 percent to 6.9 percent. By adopting a more conservative assumption for our future investment performance, the impact of market downturns is greatly reduced, which makes it less likely that future funding shortfalls will occur.

- Transitioning from level percent of payroll to level dollar amortization over five years. The prior funding system used a level percent of payroll calculation that back-weighted repayment of the debt, resulting in payments in the years approaching 2032 that would have grown precipitously.

- Moving to Entry Age Normal cost methodology to align with industry best practices.

- Maintaining 2032 as the payoff date for the unfunded liability accrued through December 31, 1983 (about $4.3 billion in unfunded liability); and

- Extending the amortization period for the balance of the unfunded liability in a new 30-year period. By extending the date for a portion of the existing funding shortfall from 2032 to 2046, responsibility for repaying this debt (which was accumulated over decades) is not disproportionately borne by only the next 14 years of tax-payers.

The new 30-year amortization period will include a new mechanism to SERS, which will allow for future gains or losses to be amortized over 25 years, thus absorbing market shocks or actuarial variance over a longer period of time rather than back loading the amortization period and resulting in large actuarial required contribution (ARC) payments that would destabilize the budget. Connecticut’s pension liability has been building since 1939 and a single generation of taxpayers should not be responsible for resolving the entirety of the problem.

“I am very grateful to SEBAC leadership that we were able to reach this much-needed and forward-looking agreement. It was incumbent upon us to reform this system before facing the fiscal crisis that could have resulted from $4 to $6-billion-dollar annual ARC payments,” Governor Malloy said. “This agreement does not alter employee benefits or employee contributions in any way – it simply allows the state to fully fund its obligations at realistic amounts that will end with Connecticut resolving the unfunded liability and emerging with a system that is fully funded. We are holding true to the ideal of improving the financial landscape for future generations.”

“I applaud Governor Malloy and SEBAC for finding resolution to these very complex issues. These negotiations highlight how committed we all are to addressing the budget challenges facing the state – keeping our promises to the men and women who have given years of service to Connecticut, and ensuring budget sustainability. I congratulate the Governor and SEBAC on this success and thank them for their work,” Lt. Governor Nancy Wyman said.

“Under the new methodology, the state will remain on schedule to vanquish $4.3 billion in unfunded liability by 2032 and will resolve the remainder of the unfunded liability by 2046 – but with the ARC smoothing out over the new 30-year schedule to remain between $1.5 billion and about $2.3 billion, providing much needed stability and predictability to the budget and to the marketplace,” Office of Policy and Management Secretary Ben Barnes said. “I would like to thank the leadership of SEBAC for being great partners throughout this process and helping us reach an agreement that will improve the state’s finances and help support the SERS system into the foreseeable future. I would also like to thank Treasurer Denise Nappier and Comptroller Kevin Lembo for their contributions.”

A new valuation of SERS will be completed based on these changes and should be ready and available in the coming weeks. The new valuation will give a more accurate and complete projection of ARC payments in the out-years.

Background:

- SERS was funded at 41.5 percent as of June 30, 2014 – among the lowest rates in the nation.

- SERS was established in 1939, but not pre-funded until 1971. The years of unfunded benefits saddled us with billions in unfunded liabilities.

- Historically, Connecticut has fallen short when it comes to calculating the appropriate payment to keep the unfunded liability from growing and then making the full payment.

- Prior to 2000, SERS calculated amortization payments would have reduced the unfunded liability- if paid- but failures to prioritize these payments led the State to underpay for many years. At Governor Rowland’s insistence, from 2000 onward, the amortization payment was calculated using a methodology that allowed the unfunded liability to grow for many years before declining. So, while the State paid more of its required contribution after 2000, the contributions were inadequate to keep the unfunded liability from growing.

- The use of “level-percent-of-payroll” has added a combined $2.3 billion in unfunded liabilities to SERS, while underpayment of the required contribution, however calculated, has added a combined $3.2 billion in unfunded liabilities to SERS.

- Actuarial experience has accounted for $4.1 billion in unfunded liabilities for SERS since 1985. One contributing factor may be the ad-hoc early retirement incentive programs (ERIP) introduced in 1989, 1992, 1997, 2003, and 2009. These programs directly impact the retirement patterns of members and likely cause dramatic deviations from the existing actuarial assumptions for retirement. Overall, we estimate that at least $1.5 billion, or just over a third, of the $4.1 billion is directly due to the ad-hoc ERIPs.

- The remaining portion comes from deviations in other assumptions such as mortality, turnover, and salary growth, and likely includes some residual impacts of the ERIPs.

- Twitter: @GovMalloyOffice

- Facebook: Office of Governor Dannel P. Malloy