For more information, read the full story by clicking this link.

The Department of Revenue Services (DRS) often receives information from other state agencies (in-state and out-of-state) as well as from the Federal government (IRS) regarding outstanding liabilities you may have. When we are notified of an outstanding liability the law requires us to send your refund or overpayment to that agency. We will notify you in writing if your refund or overpayment is offset by an outstanding liability. The notice will reflect the original refund amount, your offset amount, the agency receiving the payment, and the address and telephone number of the agency. Contact the agency shown on the notice if you believe you do not owe the debt or you are disputing the amount taken from your refund.

This page contains:

-

Answers to Frequently Asked Questions about the program

General Information about the Treasury Offset Program

The Treasury Offset Program (TOP) is a debt collection program administered by Financial Management Services (FMS), a bureau of the U.S. Department of the Treasury. This program allows state agencies to submit past-due, legally enforceable state income tax obligations to FMS for offset of the debtor’s individual federal income tax refund. If a taxpayer has a past-due Connecticut income tax liability, the Connecticut Department of Revenue Services will send the taxpayer a Notice of Intent to Offset by certified mail. The taxpayer then may take one of the following steps to avoid an offset of his or her federal income tax refund.

How to Avoid an Offset

To avoid the offset, you must take one of the actions described below within 60 days from the date of the certified Notice of Intent to Offset.

-

Pay the Debt in full:

-

Request a Review

Connecticut Department of Revenue Services

Collection & A/R Management

450 Columbus Blvd. Ste. 1

Hartford CT 06103

Do you have a current payment plan in place with DRS? If so, you should continue to make your payments on schedule. However, even if you have a payment plan, DRS will offset your federal (and state) tax refunds to satisfy any remaining balance.

Bankruptcy

If you have filed for bankruptcy, please contact us immediately. You may call the Department of Revenue Services Bankruptcy Unit between

Connecticut Department of Revenue Services

Collection Unit - Bankruptcy Team

450 Columbus Blvd. Ste. 1

Hartford CT 06103

Provide us with your bankruptcy case number and the bankruptcy court. Although you are not subject to offset of your federal income tax refund while the bankruptcy “automatic stay” is in effect, you still are obligated to file tax returns.

-

What is a “Treasury offset”?

-

Can an offset be avoided?

A. Yes. You must pay the balance of all tax liabilities listed in the notice, including ongoing interest, within the 60-day time frame provided in the Notice of Intent to Offset letter. If the debt is not resolved within 60 days, the department will send our request to FMS to offset any federal income tax refund you may be entitled to receive.

-

Will the department charge me any fees if my federal refund is offset to my state income tax debt?

A. No.

-

I paid the Department of Revenue Services in full, but my federal refund was still offset. What should I do?

A. At the time your debt was submitted to FMS, the account was not paid in full. Although the Department of Revenue Services sends updated information to FMS to reflect a change in the balance due, it is possible that the amount offset will be more than the balance due at the time of the offset. The department will refund any overpayment to you once it has been posted to your account. If your federal refund was from a jointly filed return, your overpayment will be issued in both names.

-

Your notice says my federal refund will be offset for state income taxes owed for a year in which I did not file a Connecticut income tax return. If I file my return and prove that I do not owe any tax, will you refund the money that was offset from my federal income tax refund?

A. If you file the return and you prove that all the tax due for that year was paid through withholding or estimated payments, the money that was offset from your federal income tax refund will be returned to you. NOTE: You may also be due a refund if the tax withheld or paid through estimated payments exceeds the amount of tax due. However, no refund for overpayment of withholding and/or estimated payments will be issued if the return is filed beyond the three years from the due date (or extended due date) of the return.

Mail the return and any documentation of withholding to:

Connecticut Department of Revenue Services

Collection & A/R Management

450 Columbus Blvd. Ste. 1

Hartford CT 06103

Or Fax the information to the Enforcement Unit at 860-297-5843

-

I have a payment plan in effect with the Department of Revenue Services. Will you still offset my federal refund?

A. Yes. The department will continue to pursue federal offset activity even though you are meeting your payment arrangements as long as there is any unpaid balance. We also will offset any Connecticut state income tax refunds you may receive until the amount is paid in full. Even if you receive a Notice of Intent to Offset from the Department of Revenue Services, you should continue to make any scheduled payments until the debt is paid.

-

Will you notify FMS of any changes to my balance for payments I make to the Department of Revenue Services?

A. Yes. The department will send updated account information to FMS.

-

How soon will the federal refund that was offset show on my account?

A. Allow a minimum of four weeks for the department to receive the payment from FMS and for the payment to appear on your account.

- I have been notified by FMS that my federal tax refund will be offset so I will not receive my full federal refund. I believe that I have paid off the debt and need to resolve this issue. Whom do I contact?

A. You should contact the Department of Revenue Services at the address or phone number provided to you on the notice. A department representative can confirm your balance information. The department will refund any overpayment to you once it has been posted to your account. If your federal refund was from a jointly filed return, your overpayment will be issued in both names.

A. Send a copy of the FMS letter informing you of the federal refund offset immediately to:

Connecticut Department of Revenue Services

Collection & A/R Management

450 Columbus Blvd. Ste. 1

Hartford CT 06103

Or Fax the information to the Enforcement Unit at 860-297-5843.

Your account will be reviewed and any necessary actions to adjust collection activity will be taken upon receipt of proof of the federal offset.

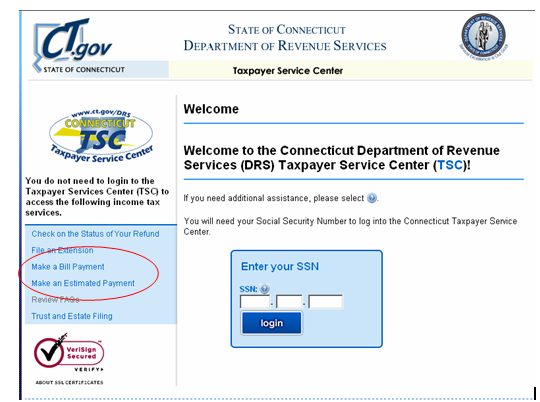

A. Yes. Use the coupon included in the Notice of Intent to Offset to send in your payment within 60 days of the date of the certified Notice of Intent to Offset. You may also pay electronically, by using the Income Tax Payment option on the TSC-IND. If you use the TSC-IND to make the payment, you do not have to mail in the coupon at the bottom of the letter.

A. You must complete IRS Form 8379 and send it to the IRS to get your share of the refund. You may download the form from the IRS website at www.irs.gov or call the IRS at 1-800-829-3676. If you have questions about the form or need help completing it, call the IRS at 1-800-829-1040. The completed Form 8379 should be mailed to the IRS center where you sent your original tax return. The IRS will notify the Department of Revenue Services when they apportion your refund, and we will adjust your account. If you still have an amount that will be offset, include a copy of IRS Form 8379 when you file your federal tax return.

A. Under the federal Debt Collection Improvement Act (DCIA), an administrative offset such as the Treasury Offset Program (TOP) may be used to collect debts, including funds or property owned by a person to a state (including any past-due support being enforced by the state). The Secretary of the Treasury has the discretion to collect debts owed to states by offset; it is not mandatory. A reciprocal agreement must be made with the state and the appropriate state official must request the offset. Connecticut has signed an agreement with the Treasury Department to participate in TOP.

- Can I pay my bill online?

A. You can make bill payments or estimated payments after you create your account in the Taxpayer Service Center (TSC-IND). You can also make bill payments or estimated payments without creating an account on the TSC by choosing the appropriate payment option from the list on the left-hand side of the Welcome screen.