Press Releases

08/05/2021

Attorney General Tong, DRS Commissioner Boughton Warn Consumers of Fraudulent Letters About Unpaid Tax Debt

(Hartford, CT) — Attorney General William Tong and Department of Revenue Services Commissioner Mark D. Boughton today are warning Connecticut consumers of a scam in which they receive a threatening letter about unpaid federal tax debts.

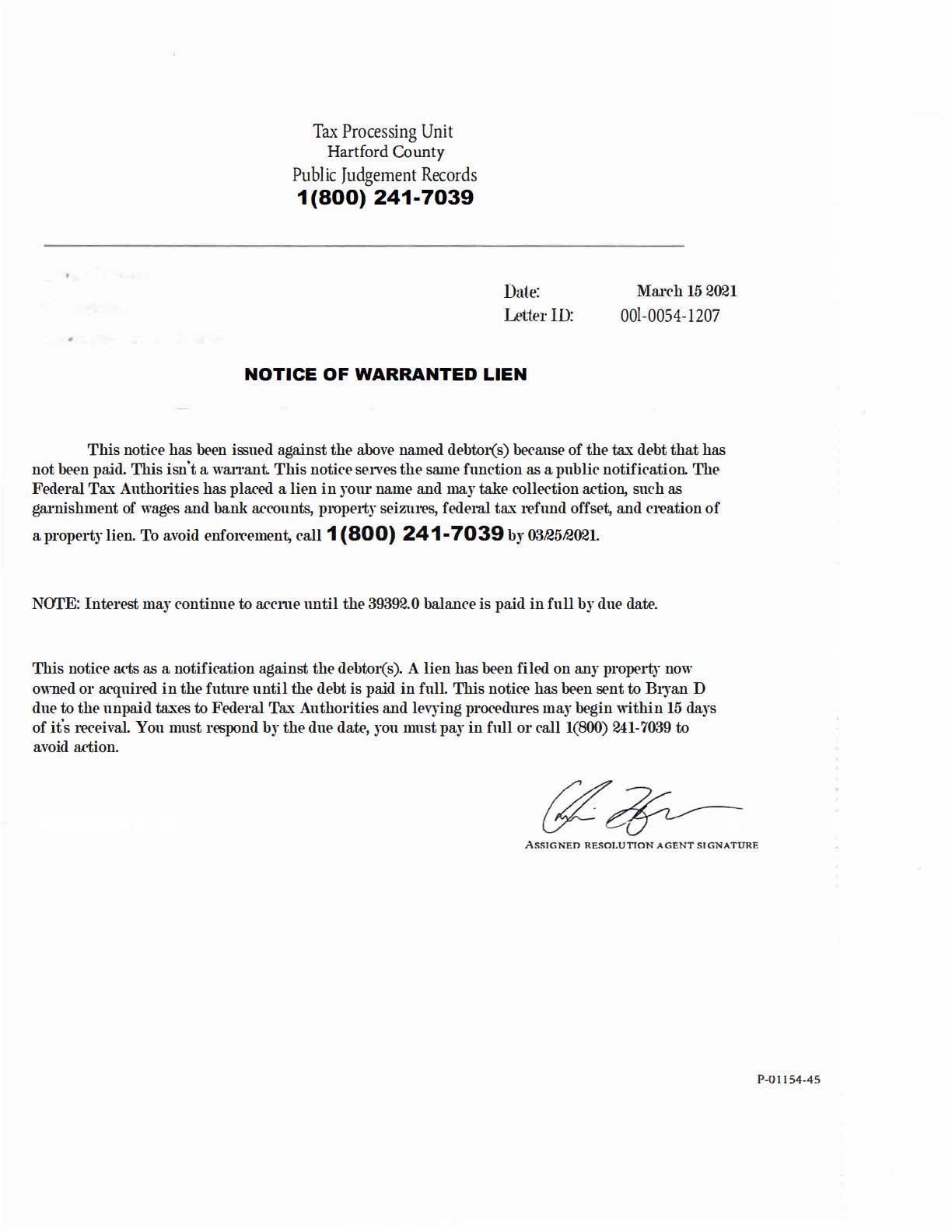

The fraudulent letter claims to be from a “Tax Processing Unit” in a Connecticut county and threatens legal action for unpaid taxes and provides a number to call toavoid enforcement. This is a scam.

“These fraudulent letters designed to cheat Connecticut residents out of their hard-earned money are nothing short of egregious,” said Attorney General Tong. “Our office will continue to fight these fraudulent mailings and protect Connecticut residents from these potentially devastating scams. Anyone who has any doubts about the legitimacy of a tax-related mailing they have received should call the DRS to verify the document before sending money to a private company.”

“Where there is money and opportunity, scammers will try to take advantage,” said Department of Revenue Services Commissioner Mark D. Boughton. “With new, pandemic-related benefits flowing from Washington, DC, as well as income tax refunds being issued from federal and state tax authorities, it is more important than ever to be aware of and protect against scams like this. If there is a communication about your Connecticut taxes that you question, please contact our Department as soon as possible. A DRS professional can help determine if it is legitimate.”

At least seven Connecticut residents have contacted the Office of the Attorney General to report having received these letters.

The Internal Revenue Service (IRS) is the only agency that collects federal taxes. No county in Connecticut will ever contact residents about paying federal taxes. The letters also do not provide any documentation supporting the allegation that unpaid taxes exist. Finally, though there is a signature at the bottom of the letter, the name of the person signing the letter is not provided.

Here are some tips to avoid tax scams:

• If you receive a mailing claiming unpaid taxes, be sure to verify that it is from the IRS or your state or local government before taking any action.

• The IRS will rarely telephone taxpayers about their bills and will never demand immediate payment with a prepaid debit card, gift card or wire transfer.

• The IRS will also never demand that an individual pays taxes without the opportunity to appeal the amount and will never threaten to involve police, immigration officers or other law-enforcement. This is a common tactic used by scammers and bad actors to trick victims.

Annually, the Internal Revenue Service compiles a “Dirty Dozen” list of common scams, which it publicizes and works with state tax authorities and other partners to prevent. Learn more about this year’s “Dirty Dozen” here: https://www.irs.gov/newsroom/dirty-dozen

To report a scam or instance of fraud, contact the Office of the Attorney General at 860-808-5318 or file a complaint with the office at https://www.dir.ct.gov/ag/complaint/. To contact DRS call 860-297-5962.

- Twitter: @AGWilliamTong

- Facebook: CT Attorney General

Media Contact:

Elizabeth Benton

elizabeth.benton@ct.gov

Consumer Inquiries:

860-808-5318

attorney.general@ct.gov